Insurebot

InsureBot is an AI-powered assistant built on IBM Watson to help healthcare professionals access insurance details. Despite strong underlying tech, the experience felt rigid, cluttered, and far from intuitive—leaving users frustrated and slowing down their workflows.

My goal was to transform InsureBot into a more human, efficient, and intelligent assistant by refining conversations, simplifying flows, and modernizing its UI.

Collaboration Overview

Role

UX Designer

Duration

6 months

UX Team

1 Senior Designer, 2 UX Designers

Collaborators

1 Product Owner, Dev Team (IBM)

Problem

Although powered by IBM Watson, InsureBot struggled to deliver a seamless conversational experience. Key challenges included:

Complex and Rigid Flows

The chatbot's linear structure made it hard for users to navigate conversations or correct mistakes, leading to longer and more frustrating interactions.

Lack of Empathy and Engagement

InsureBot's tone felt robotic and impersonal, missing the human touch needed to build trust and comfort during support interactions.

Underutilized AI Capabilities

Despite being powered by IBM Watson, InsureBot failed to leverage its full potential—resulting in limited understanding, generic responses, and missed opportunities for intelligent assistance.

Business Goal

- Improve CSAT

- Reduce dependency on live agents

- Increase task completion within chatbot

- Simplify insurance journeys

Project Brief

The goal was to transform InsureBot, an IBM Watson–powered insurance assistant, into a more intuitive, empathetic, and efficient tool for healthcare professionals. Initial discovery revealed that users struggled with complex conversations, confusing navigation, and data-heavy flows, while key capabilities of Watson's NLP were underutilized.

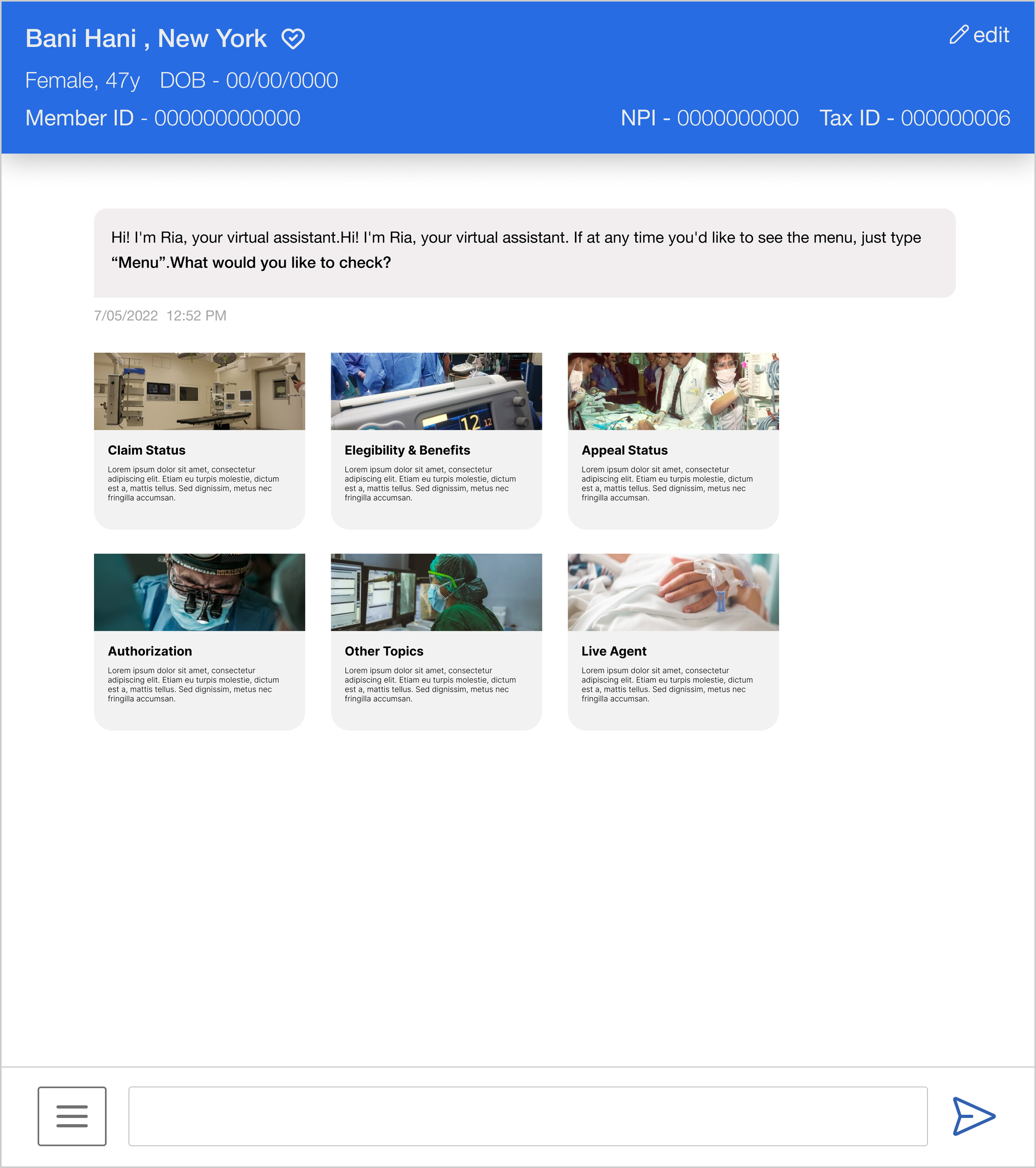

Through stakeholder discussions, competitive analysis, and heuristic evaluation, we identified critical issues such as information overload, rigid interactions, inconsistent CTAs, and a lack of branding or personality.

To address these gaps, we set clear UX goals: simplify chat journeys, humanize the tone, unify interaction patterns, and leverage AI intelligently. Using CSAT insights and impact–effort mapping, we streamlined high-priority intents (Eligibility & Benefits, Claims, Pre-Auth), introduced suggestive prompts, and designed more natural conversational flows tested through low-fidelity wireframes.

Key Focus Areas

Design Iteration

Progressive refinements were made from wireframes to final designs, focusing on improving structure, clarity, and engagement across chatbot interactions. Delivered a refined conversational experience where:

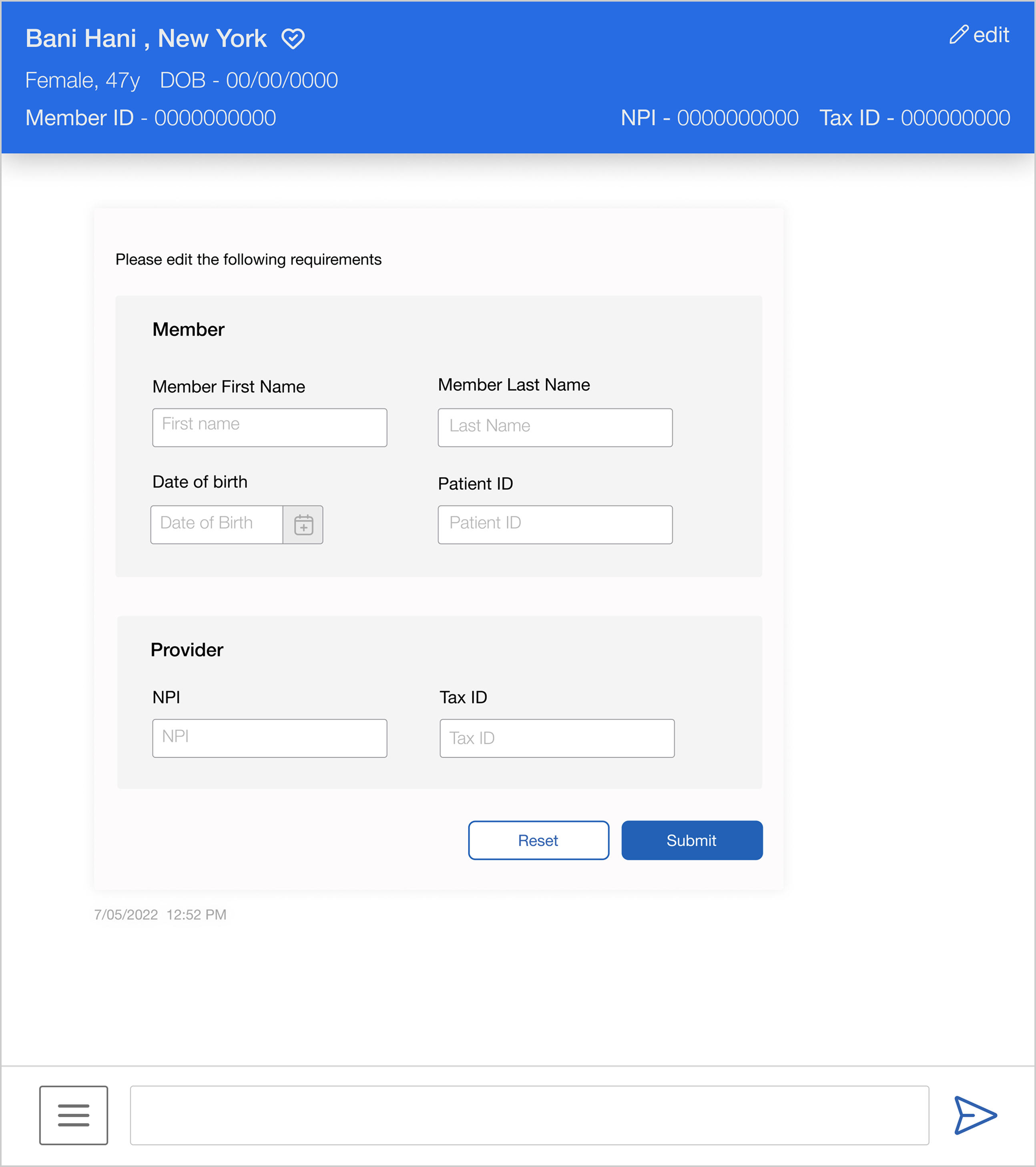

"Long pre-chat forms, unclear conversation context, and rigid bot responses caused friction and confusion; this was addressed by streamlining chat entry, introducing context banners, intent switching, guided suggestions, a humanized tone, and live-agent fallback—resulting in faster task completion, reduced cognitive load, clearer navigation, and higher user confidence in the chatbot experience."

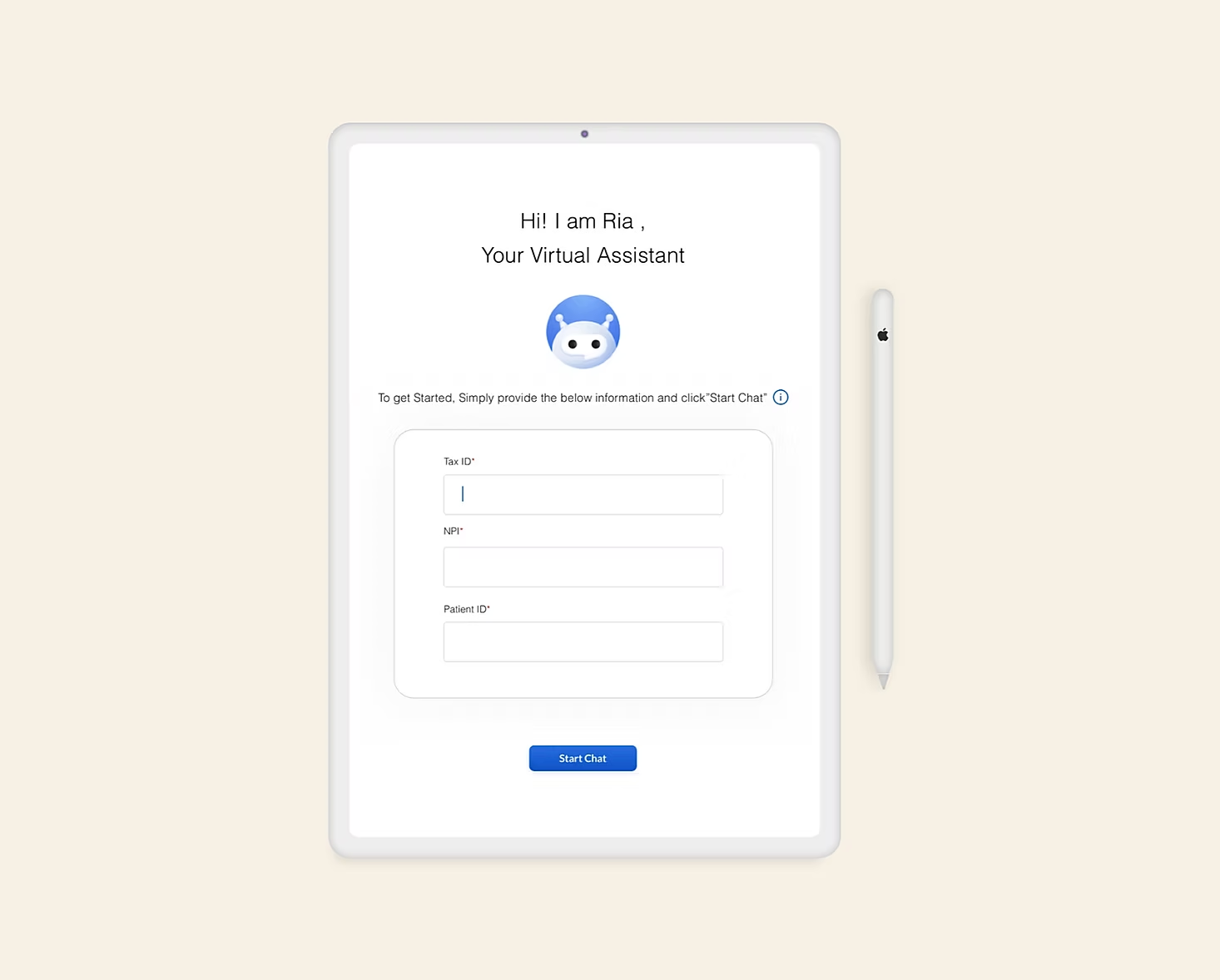

InsureBot Onboarding - Virtual Assistant Introduction

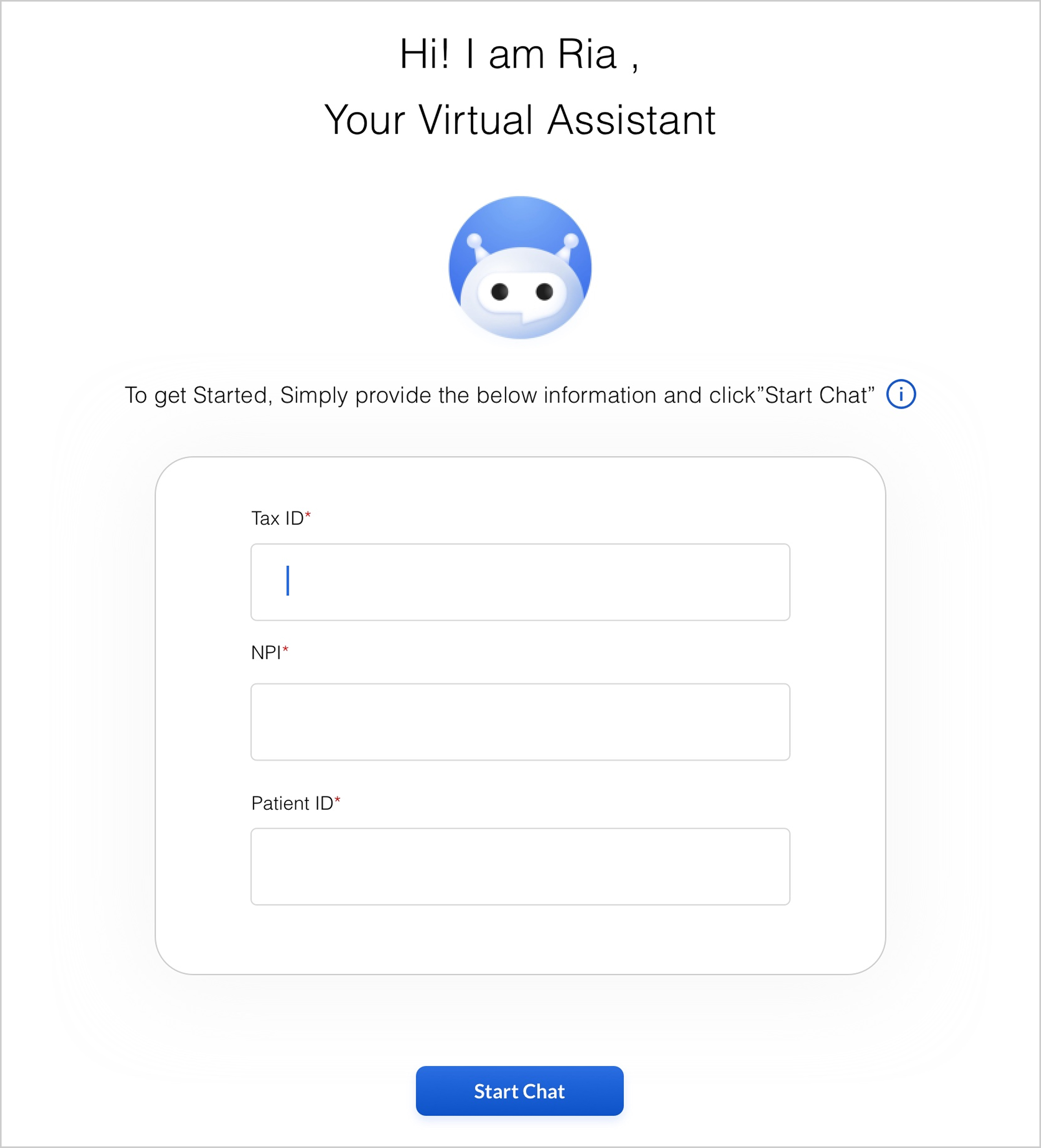

InsureBot Form - Member and Provider Details

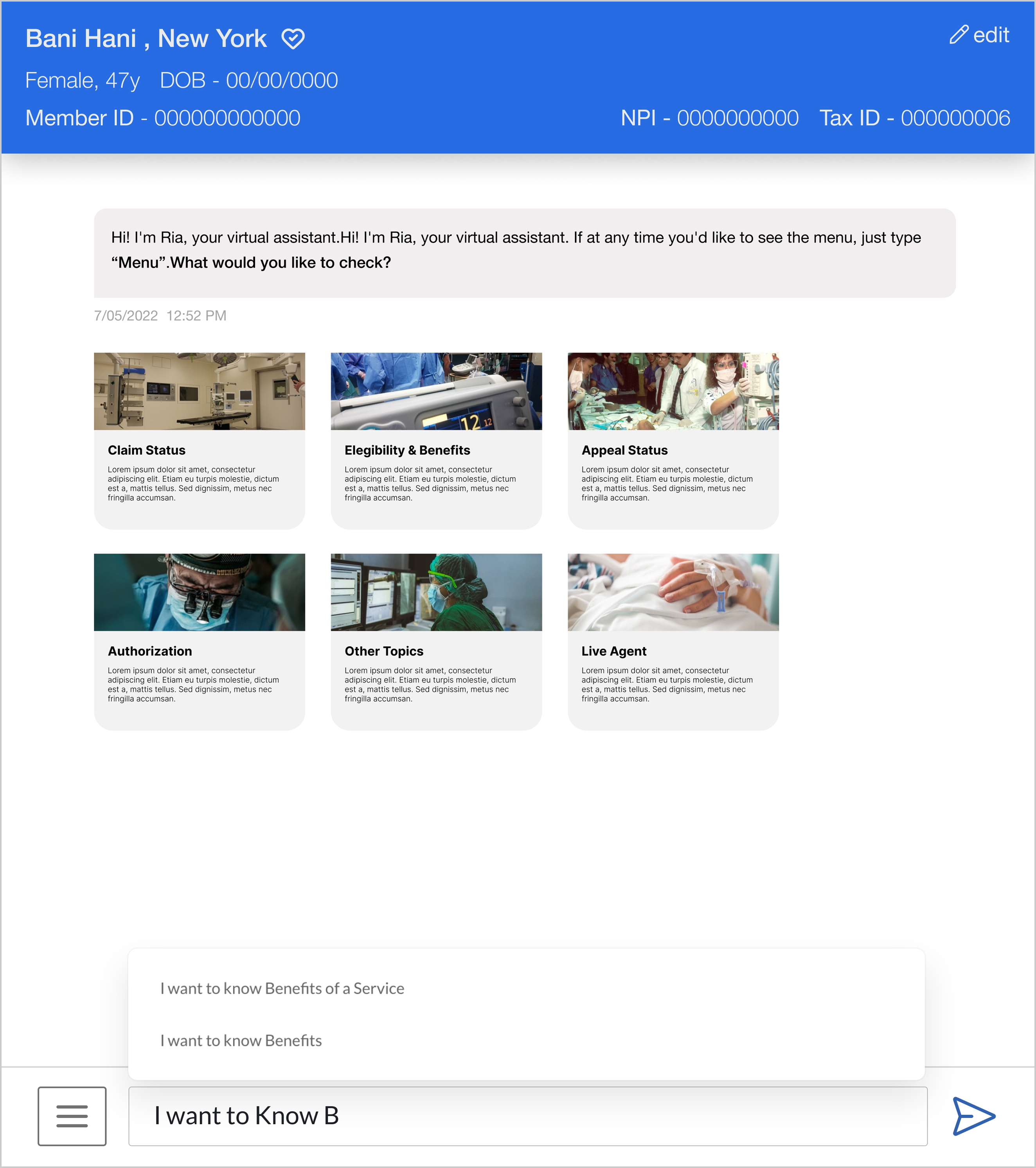

InsureBot Chat - Topic Selection Cards

InsureBot Chat - Auto-suggestions

Additional Features

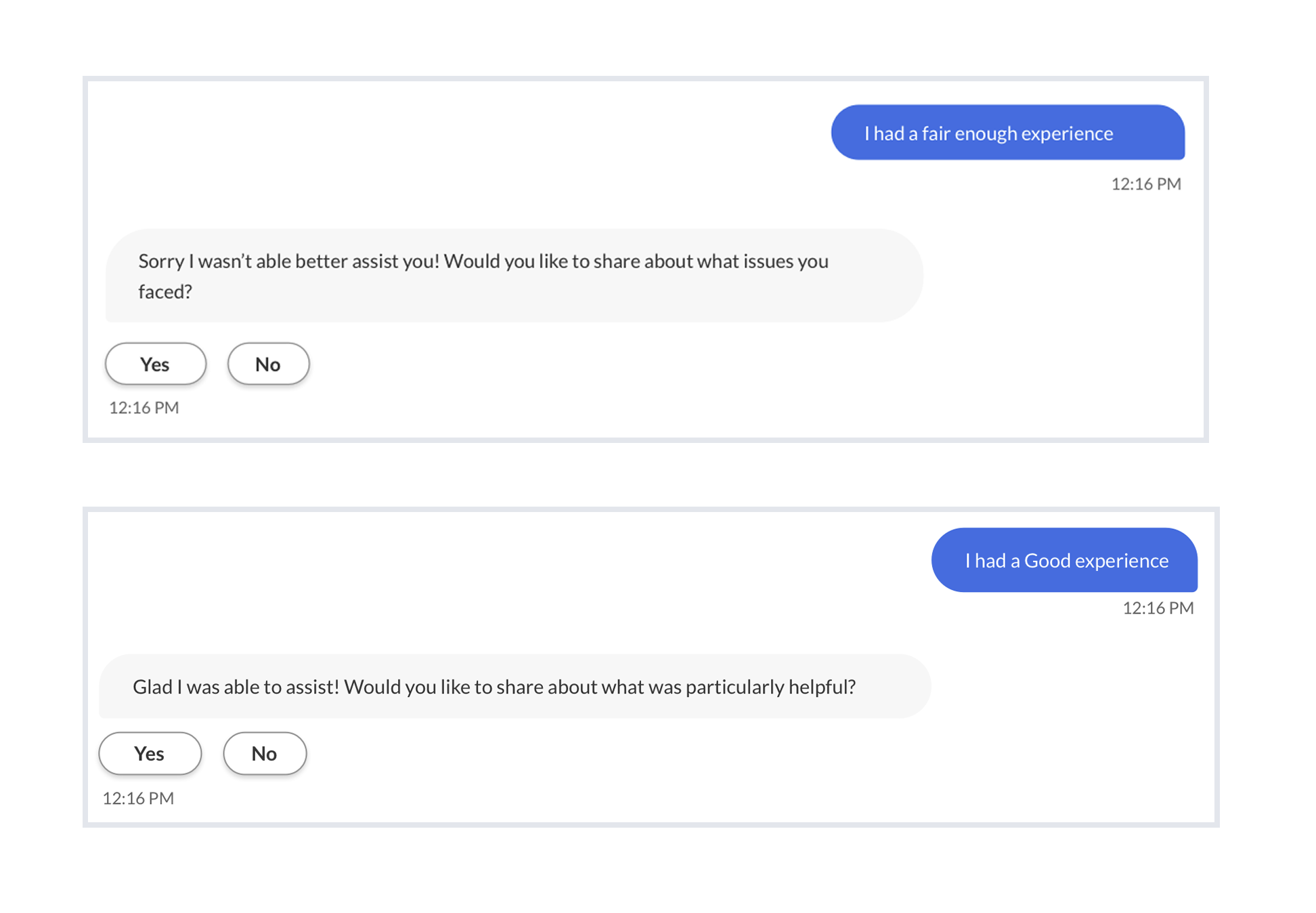

Customised natural dialog

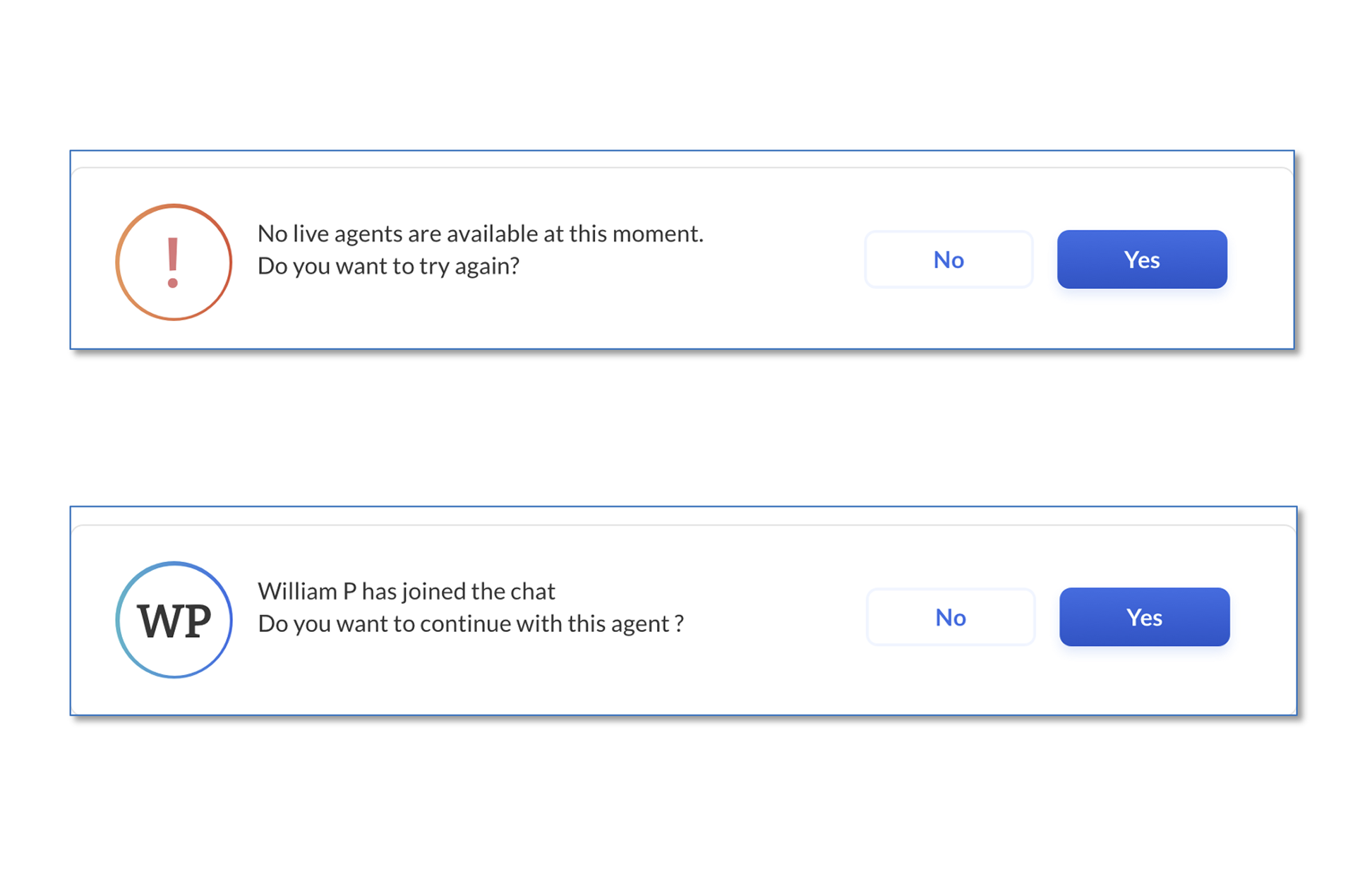

Live Agent Interaction Design

Impact

Operational & Business Impact

- 30–35% reduction in live agent escalations

- Reduced cost per conversation by increasing automated resolution

- Lowered support team workload through higher self-service containment

Task Success Metrics

- Higher in-chat task completion rates

- Reduced mid-flow drop-offs

AI Performance Metrics

- Improved intent recognition accuracy

- Reduced misclassification rate across key insurance intents

Efficiency Metrics

- Faster average resolution time

- Reduced conversation loops

User Satisfaction Metrics

- Clearer flows reduced confusion

- Humanized conversational tone improved trust

- Improved intent clarity reduced frustration

Next Project

Care Manager

A healthcare management system that streamlines program creation and facilitates patient information